Safehub Sensor Data as a Trigger for Parametric Earthquake Insurance

The time for smarter earthquake parametric coverage has arrived—powered by Safehub’s ability to deliver building-specific shaking data, and scalable sensor networks that enhance both site-specific and regional ground motion insights.

Smarter Sensor-Based Parametric Insurance

Parametric earthquake insurance is quickly becoming a valuable complement to traditional indemnity policies, offering faster payouts, simplified claims, and immediate liquidity when it matters most. As organizations look to strengthen financial resilience, parametric solutions are proving to be a smart and timely addition.

Existing parametric earthquake insurance products often rely on seismic data from public agencies, which can often be sparse, or overly generalized. This lack of localized data can lead to significant basis risk—especially when the goal of the policy is to reflect actual damage experienced by specific buildings or assets.

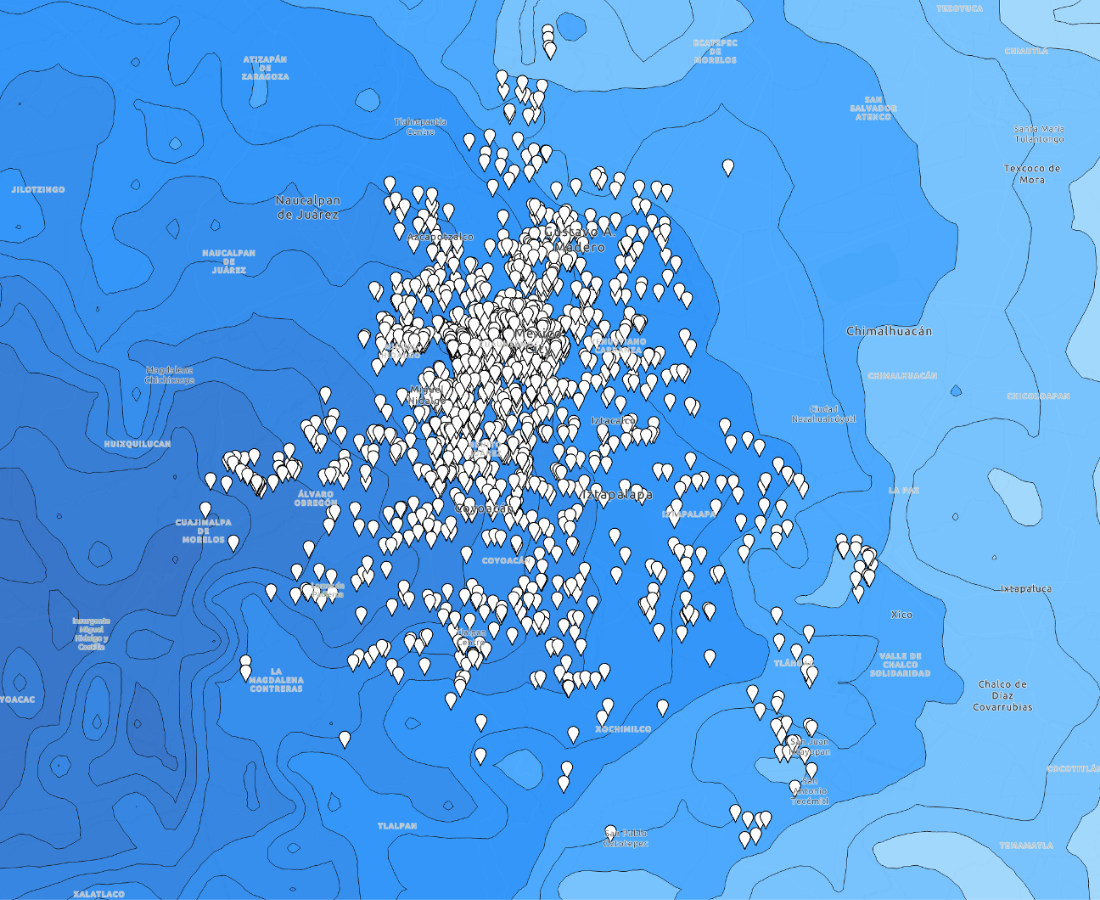

Safehub closes this gap with its low-cost, scalable sensor technology, delivering both building-specific insights from sensors in the building, and enhanced regional data through dense sensor networks. This real-time data is powering a new generation of smarter parametric policies—reducing basis risk, accelerating payouts, and delivering more reliable coverage.

En colaboración con:

ShakeNet Parametric

ShakeNet Parametric is an innovative insurance solution created in partnership with Liberty Mutual Reinsurance (LMRe). It is built on ShakeNet, Safehub’s global platform that delivers the highest-resolution regional earthquake shaking estimates available by combining government seismic networks with Safehub’s rapidly expanding sensor network. Powered by the Global Earthquake Model’s OpenQuake engine, ShakeNet provides scientifically robust, globally scalable shaking data that can be deployed rapidly, even in regions with limited post-earthquake information.

This information enables LMRe and Safehub to design data-driven parametric policies that better align payout with losses, while enhancing risk management for governments and insurers.

Site-Specific Parametric

Safehub’s building/site-specific parametric solution uses sensors installed directly at designated sites to capture the precise level of ground shaking experienced at that location. This hyper-local measurement reduces uncertainty by tying policy triggers to the actual intensity recorded at the insured building, rather than relying on regional estimates.

In addition to enabling rapid, transparent payouts, policyholders gain an added layer of protection through near real-time damage alerts and cloud-based analytics. These insights allow organizations to quickly identify impacted buildings, prioritize emergency response, and take swift action to reduce downtime and further losses.

Benefits of a Safehub Sensor-Based Earthquake Policy

Reduce el riesgo de base

A sensor, installed at the policyholder’s site, records how an earthquake impacts that specific site. When deployed across multiple buildings in a region, Safehub’s dense sensor network delivers enhanced, high-resolution regional shaking data—offering a far more granular and accurate foundation for parametric coverage than publicly available sources. The result is reduced basis risk: minimizing the difference between losses and payout.

Expedites Payouts

In the event of an earthquake, traditional indemnity insurance can take months—to over a year—for claims to be processed and payouts received. Even traditional parametric policies, which rely on public agency data, may be delayed while waiting for final shaking reports. In contrast, sensor-triggered parametric coverage powered by Safehub delivers site-specific shaking data within minutes—often enabling faster payouts and accelerating financial recovery.

Supports Emergency Response

Organizations that opt for a building-specific parametric earthquake policy powered by Safehub sensors gain an added layer of protection: access to near real-time damage alerts and cloud-based analytics. This enables both policyholders and (re)insurers to quickly identify impacted buildings, prioritize emergency response, and take swift action to reduce downtime and further losses.

ShakeNet Redefines the Rules of Earthquake Parametric Underwriting

Learn how ShakeNet Parametric is redefining the earthquake insurance playbook.

World’s Largest Sensor-Based Earthquake Insurance Policy

Liberty Mutual Reinsurance y Safehub se asocian con la Universidad de California para proteger los campus de daños por terremotos.

Contratar un seguro paramétrico contra terremotos

Estas soluciones son especialmente pertinentes ahora. Los seguros paramétricos están cada vez más extendidos y los compradores buscan soluciones más sofisticadas que se ajusten mejor a su exposición a eventos catastróficos.

Safehub’s sensor-based insurance solution is available through Liberty Mutual Reinsurance. Liberty Mutual Re is collaborating with a range of (re)insurers, brokers, MGAs, and corporations to offer clients a reliable building-specific data source that triggers earthquake parametric policies. Reach out to us today to explore how we can integrate earthquake sensors into your insurance program, or contact your current broker to begin the process of obtaining a personalized quote.

Empiece hoy mismo

Solicite una demostración para conocer cómo podemos ayudarlo a minimizar su riesgo de catástrofes con datos específicos de edificios en tiempo real.