Safehub Sensors as a Trigger for Parametric Earthquake Insurance

The time for a building-specific earthquake parametric solution has arrived.

Sensor-Based Parametric Insurance

Existing parametric earthquake insurance products use magnitude and ground-shaking estimates from public agencies to trigger payouts. These estimates are useful to understand regional impacts but do not provide a building-specific representation of how an earthquake affected specific buildings, which can create basis risk, depending on the intent of the parametric policy.

Safehub sensors, which provide remote damage estimates to corporations and government organizations are now being used to trigger parametric earthquake insurance products to reduce basis risk and expedite payouts.

This follows the trend of building-specific hail and flood sensors being adopted to trigger parametric insurance policies at an accelerated rate.

In Partnership With:

How Does it Work?

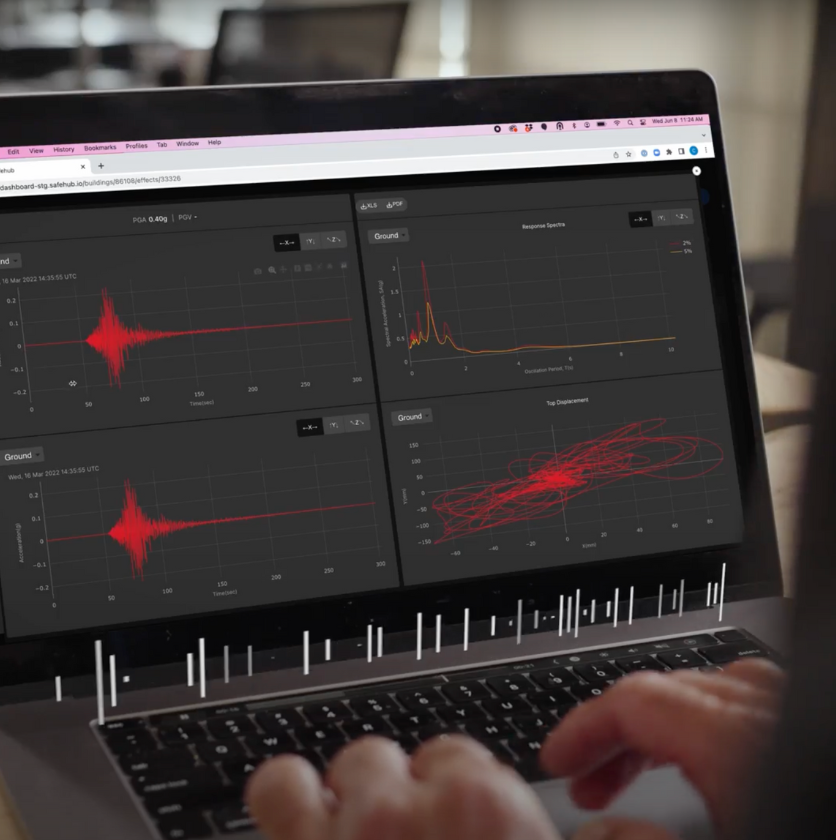

Safehub sensors are placed in strategic locations within the footprint of the building to measure site-specific ground movement in the form of Peak Ground Acceleration (PGA), Pseudo-Spectral Acceleration (PSA), or Peak Ground Velocity (PGV). This data is then used as an independent building-specific index for parametric insurance policies to trigger payouts.

This same data, in combination with vulnerability information, can be used to provide insureds and (re)insurers building-specific damage information, through alerts & dashboard analytics, within minutes.

Benefits of a Sensor-Based Parametric Earthquake Insurance Policy

Reduces Basis Risk

A sensor, installed at the policyholder’s site, records how an earthquake affected the policyholder’s location, providing a more granular approach to parametric cover. This provides the building-specific data that publicly available sources do not. The result is reduced basis risk: minimizing the difference between direct and building-related business interruption losses, and the payout.

Faster Payouts

In the event of an earthquake, traditional parametric insurance policies utilize data from public agencies, often waiting a pre-determined amount of time for final data, which delays payouts. The data for sensor-based parametric policies is received within minutes, therefore reducing the amount of time for eventual payout.

Expedites Emergency Response

Organizations that purchase parametric insurance using Safehub sensors also benefit from access to earthquake damage alerts and cloud-based analytics. This allows corporations and (re)insurers to identify damaged buildings quickly and put in place response and mitigation efforts.

World’s First Sensor-Based, Parametric Earthquake Treaty

Liberty Mutual RE, XS Global and Safehub announce world’s first sensor-based, parametric reinsurance treaty for earthquake risk.

Getting Parametric Earthquake Insurance

These solutions are particularly pertinent now. Parametric insurance is becoming more widespread and buyers are seeking more sophisticated solutions that better align with their exposure to catastrophic events.

Safehub is working with (re)insurers, brokers, MGAs, and corporations as the building-specific data source to trigger earthquake parametric policies. Contact us today to learn more about how we can help you incorporate earthquake sensors into your insurance program.

Get Started Today

Request a demo to learn how we can help minimize your catastrophe risk with building-specific, real-time data.