Springing Forward from “Trembling & Triggers” to the Latest Quakes & Collaborations

Many organizations have large earthquake exposures where traditional insurance falls short. Key losses are excluded, deductibles are high and claims take months or years to settle. In the last five years, more companies have turned to parametric insurance for tricky catastrophe risks. But how can you ensure the payout accurately reflects how a building was affected by an earthquake?

Earlier in 2024, Safehub, Liberty Mutual Reinsurance and MGA XS Global participated in a webinar hosted by InsTech to discuss sensors and parametric insurance for earthquake risks. This article reflects on that webinar a few months later, following several large global earthquakes: the April M7.5 earthquake in Taiwan that Safehub’s sensors have been used to collect data for, as well as an exclusive partnership announcement between Safehub and Liberty Mutual Re, expanding its solution globally.

Responding to recent earthquakes

Safehub’s sensor technology is installed in buildings across earthquake-prone areas around the world. It measured two significant earthquakes surrounding the time of the last webinar: a 5.8 magnitude event on 7 December 2023 in Mexico City and a 7.6 magnitude event in Ishikawa, central Japan, on New Year’s Day 2024.

“Our clients who had buildings in the Tokyo area received alerts to say that their buildings were shaken, but unaffected. This allowed them to continue business operations with confidence.” – Andy Thompson, CEO and Co-founder, Safehub

Since then, Taiwan was rocked with a similar M7.5 earthquake in April. However, unlike the quake in Japan, Safehub sensors helped their clients in the area in a different way. Safehub sensors collected data from buildings in the area and determined a potential for damage in some client buildings. This enabled them to prioritize emergency response for those sites, while allowing them to resume business in the others.

Prior to the webinar, Safehub also launched an earthquake parametric insurance treaty with XS Global in Mexico City, which was put to the test for the first time. Safehub provided an incident report to XS Global and Liberty Mutual Re shortly after an earthquake on 7 December. It was the first incident report tied to a sensor-triggered policy that was delivered after an earthquake. The shaking was not sufficient to trigger any pay-outs and there were no damages reported.

“For our clients who have operations, retail stores or facilities in Mexico City, often with hundreds of people, the ability to have information [about how the earthquake affected their premises] immediately was a pleasant surprise.” – Alejandro Solorzano, Head of Alternative Risk Transfer and Innovation, XS Global

Since then, Safehub and Liberty Mutual Reinsurance have announced an exclusive partnership. It allows global organizations access to a parametric insurance product that pays out automatically when the shaking measured by a sensor at their location exceeds a certain threshold.

The problems parametric insurance is solving

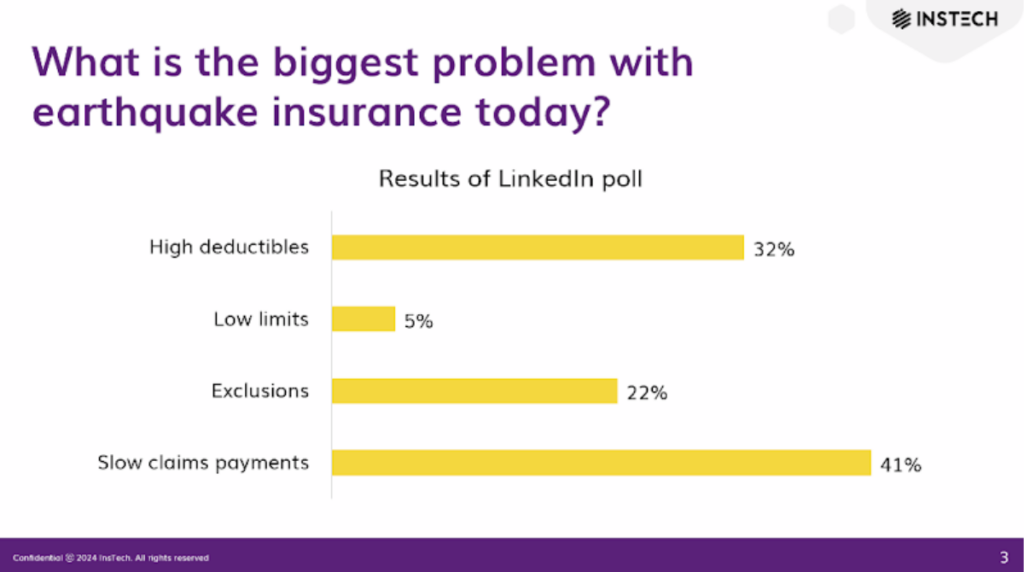

InsTech ran a poll to research the challenges in the earthquake insurance market. It found that slow claims payments was one of the biggest problems, followed by high deductibles and exclusions.

Deductibles, exclusions and delays in claims payments mean that many organizations are more exposed to earthquakes than they would like to be.

“In lots of countries sensitive to earthquakes, particularly Mexico, most large corporations are lacking in coverage. Due to large deductibles, in recent earthquakes in Mexico, the total insurance pay-out was small… We have also seen in recent events such as the 2021 Acapulco earthquake that there are not enough loss adjusters on the ground to assess claims, causing a delay in payment.” – Jean-Christophe Garaix, Head of Agriculture and Parametrics, Liberty Mutual Reinsurance

While insurance traditionally pays claims based on an assessment of loss, parametric insurance pays out predefined amounts based on event triggers, usually weather or catastrophic events. This means pay-outs can occur more quickly, and parametric pay-outs can be used for almost any purpose, such as emergency expenses, costs in a traditional insurance deductible or business interruption.

“In our experience with parametric earthquake and hurricane policies, the loss report is completed within 24 hours. At that point the insurance company and the client know exactly what the pay-out will be. The client needs to confirm to the insurer that they experienced a loss. Then the payment can be done quickly, with money received in the client’s bank account within seven days.” – Alejandro Solorzano, Head of Alternative Risk Transfer and Innovation, XS Global

Measuring earthquakes for parametric insurance

Parametric earthquake insurance has existed for more than two decades. Usually the data that triggers a pay-out relates to either the magnitude of the earthquake and the insured assets distance from the epicenter, or an estimate of the shaking at the insured location from a public agency such as the US Geological Survey.

Measurements such as magnitude and shaking estimates are useful for measuring the overall impact of an earthquake over a broad area. When it comes to how an individual asset or building is affected by an earthquake, these measurements fall short; even buildings that are on the same street may shake differently depending on their structure and the materials in the ground beneath them.

Sensors from Safehub provide the most asset-specific information about earthquakes. The partnership with Liberty Mutual Reinsurance means that companies can now have parametric insurance policies that pay out based on measurements from a sensor on their building. This results in more precise pay-outs and minimal basis risk.

“There are different tools suited for different jobs. Cat-in-a-circle [where pay-outs are based on magnitude and distance from epicenter] and ShakeMap can be the right parametric trigger for certain situations. But if an organization’s concern is building-specific, using building-specific data matters. We can measure it.” – Andy Thompson, CEO and Co-founder, Safehub

Sensor-based insurance gains momentum

The panel discussed the increasing interest that corporations and brokers are showing in the sensor-powered parametric earthquake insurance product. Alejandro described how data from sensors helps brokers give their clients certainty after an event: if the ground shaking measured by the sensor is not significant, there is unlikely to be much damage or insurance pay-out. If the ground shaking is significant and the parametric policy is triggered, the client is more likely to expect a pay-out from its property insurance as well.

“We started with a pilot in Mexico, because we see Mexico as the most complicated area for earthquake assessment. Now we offer coverage worldwide. We are looking for local distribution networks to reach new clients. Our approach is not to compete with traditional insurance: we see parametric mainly for filling gaps in coverage such as business interruption and offering fast payments.” – Jean-Christophe Garaix, Head of Agriculture and Parametrics, Liberty Mutual Reinsurance

Learn more at safehub.io/earthquake-response/parametric-insurance/.