Parametric insurance, where policies pay out predefined amounts based on trigger events, is helping corporations around the world manage their catastrophe risks. While traditional insurance for vulnerable properties and assets often comes with large deductibles or lower-than-required limits and a lengthy claims process, parametric insurance opens up new capacity and pays quickly to cover immediate costs.

Because parametric pay-outs depend on trigger events rather than the exact loss a company experiences, it is important to structure a policy that will respond in the right way when a shock event happens. In the past, some organizations have purchased parametric policies that did not meet their expectations during a catastrophe. Companies that are considering taking advantage of the transparency, flexibility and speed of a parametric policy should make sure they consider these three aspects to ensure successful coverage: using an index that reflects the risk; setting the right trigger point; and choosing a data source that responds quickly.

When companies buy insurance products that turn out to be unsuitable and leave them on the hook to bear the costs of a catastrophic loss, neither they nor their insurers tend to reveal the details publicly. For this reason, the few examples of where parametric insurance didn’t deliver as expected that we discuss in this article come from the public sector.

1: Use an index that reflects the risk

The African Risk Capacity (ARC), a risk pool protecting African governments and populations against climate and catastrophic risks, provided parametric drought insurance to the government of Malawi from 2015 to 2016. A severe drought occurred during the policy period, but no immediate pay-out was triggered under the parametric policy.

ARC uses a risk model to determine when parametric pay-outs are due. It monitors precipitation, modeling how the timing, amount and distribution of rainfall will affect crop yields, to measure drought. Then it overlays the measure of drought onto a population vulnerability index to estimate the amount of people who would be affected by the drought and the cost to assist them.

In the 2015/16 policy year, many people in Malawi were affected by drought, but ARC’s model had calculated the impact to be much lower. After a review, it was discovered that the model relied on out-of-date information about what crops were being grown where. As a result, the coverage was adjusted and ARC made a pay-out of $8.1 million USD to Malawi’s government. ARC has continued to adjust its models since and increasing numbers of African countries are using its coverage to fund relief efforts after droughts, cyclones and other catastrophes.

Whatever the peril, it is important to make sure that a parametric policy’s index – the measure of the event which the policy offers protection for – accurately represents the on-the-ground impact of a catastrophe.

2: Set the right trigger point

The World Bank purchased a parametric catastrophe bond in 2017 covering pandemic risks. The bond was intended to help the World Bank’s then-newly-created Pandemic Emergency Financing Facility (PEF) direct hundreds of millions of dollars in funding to developing countries rapidly when they were at risk of a spreading pandemic.

This bond was criticized in the early onset of the COVID-19 pandemic in 2020. The bond’s trigger relied on any pandemic meeting certain thresholds of cases and deaths globally and across several countries, as well as a growth rate in cases calculated to be ‘exponential’ in selected countries.

These thresholds were not met until 31 March 2020 and that was first confirmed on 17 April, with the first pay-outs being disbursed to governments in May. By that time, there were already over 3 million cases of COVID-19 confirmed across 215 countries and territories. Vulnerable countries could have benefited from earlier funding to put preventative measures in place to limit the spread. The World Bank later decided not to pursue future efforts for pandemic risk transfer.

Whatever the catastrophe that parametric insurance is protecting against, it is important to set the right trigger point. Otherwise, organizations risk being caught out, like vulnerable countries in early 2020 with COVID-19, when a catastrophe hits that does not quite meet the required thresholds for a pay-out but causes a large loss.

3: Chose a data source that responds quickly

The government of the Philippines purchased a parametric catastrophe bond in 2019 for $225 million of protection against earthquake and tropical cyclone risks. In mid-December 2021, Typhoon Rai (known in the Philippines as Typhoon Odette), caused 410 deaths and $1 billion in economic losses, according to Aon.

It was not until over a month later, on 24 January 2022, that the bond’s calculation agent was able to confirm that the thresholds for a pay-out had been met and that funds could begin to be disbursed. The final calculation process relied on even more data and the final amount that would be paid was not finalized until mid-May. When its catastrophe bond coverage expired, the Philippines government decided not to renew it, choosing traditional, indemnity-based insurance over parametric.

Almost immediately after a catastrophic event, organizations face disruption to normal operations and begin to incur emergency expenses. Parametric policies are ideal to cover immediate costs, but uncertainty about how much will be paid and delays in receiving funds hamper organizations’ ability to make decisions.

Most parametric policies will provide assurances that pay-outs will be settled within around a month. Some have been known to pay out just hours after an event. The time between an event and a pay-out depends on the data sources used and the calculation agent: it is important to choose a data source that will respond quickly.

How to build resilient triggers for parametric earthquake insurance

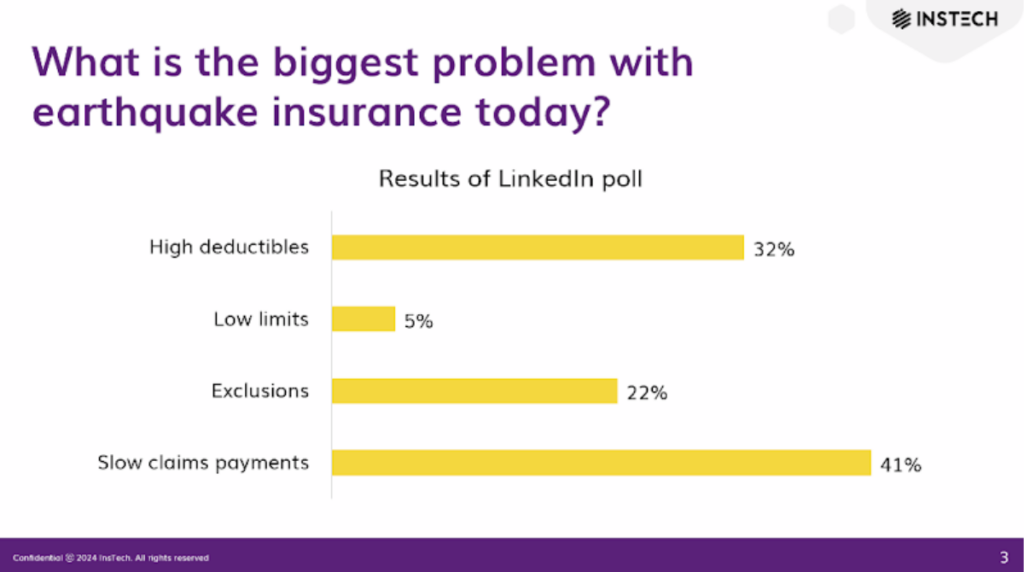

More corporations than ever are turning to parametric insurance to cover earthquake risks, driven by high deductibles, exclusions and slow claims payments from traditional insurance. But it is only when an earthquake hits that their coverage will be tested. With parametric insurance, it is vital that companies use an index that truly reflects their risk, set the right trigger point and choose a data source that responds quickly.

Safehub, whose compact sensors are being used for earthquake risk management by large corporations around the world, is now providing its technology to provide asset-specific earthquake data for parametric insurance in partnership with Liberty Mutual Reinsurance.

This means the index that a parametric policy relies on reflects more precisely how an insured building or asset is affected by an earthquake. Safehub’s data can help corporations set trigger points where they expect to experience a loss. The data is reported quickly, with alerts within minutes helping organizations respond and enabling insurers to calculate and disburse a pay-out within a short period.

Learn more at safehub.io/earthquake-response/parametric-insurance/.